In March 2020, when world markets were being smashed by COVID noise, we spent a lot of time speaking with our clients and helping them stay calm in the face of volatility we’ve seen before, and we’ll see again.

Times are good for investors right now – world markets have stabilised and despite COVID and its effects on the world’s economies still being a constant cause for concern, things are less noisy at the moment.

So we figured this might be a good time to offer a refresher on how to stay calm when the next bunch of noise arrives!

Understanding natural human biases

Before you can turn down the noise, it’s important to understand that we humans are wired to hear it. The human brain has evolved to pay a lot of attention to danger and to be very risk-averse. Further, studies have shown that we are more pre-disposed to ‘avoid loss’ than we are able to ‘appreciate gain’.

These traits were helpful in the Pleistocene age where being on high alert all the time primed you to be able to evade sabre-toothed tigers who wanted to have you for dinner. It’s a trait that’s much less helpful in modern times.

Unfortunately, media outlets understand the human brain’s predisposition for paying greater attention to bad news than good, and that’s what we’re all fed a steady diet of each day.

Not only that, but instead of only receiving news from the tv, radio and newspapers, we all now have access to an endless stream of information (and misinformation) right in the palms of our hands via our phones.

4 tips for staying focused as an investor

Remember that the power of investing lies in the power of compound interest. And you can only benefit from the power of compound interest if you are able to stay the course long term. So given the world is set up to take advantage of our natural predilection for worry and paying attention to ‘danger’, how do we stay calm in the face of all that noise in order to stay the course?

Here are four tips.

1. Remember that volatility from world worries is normal

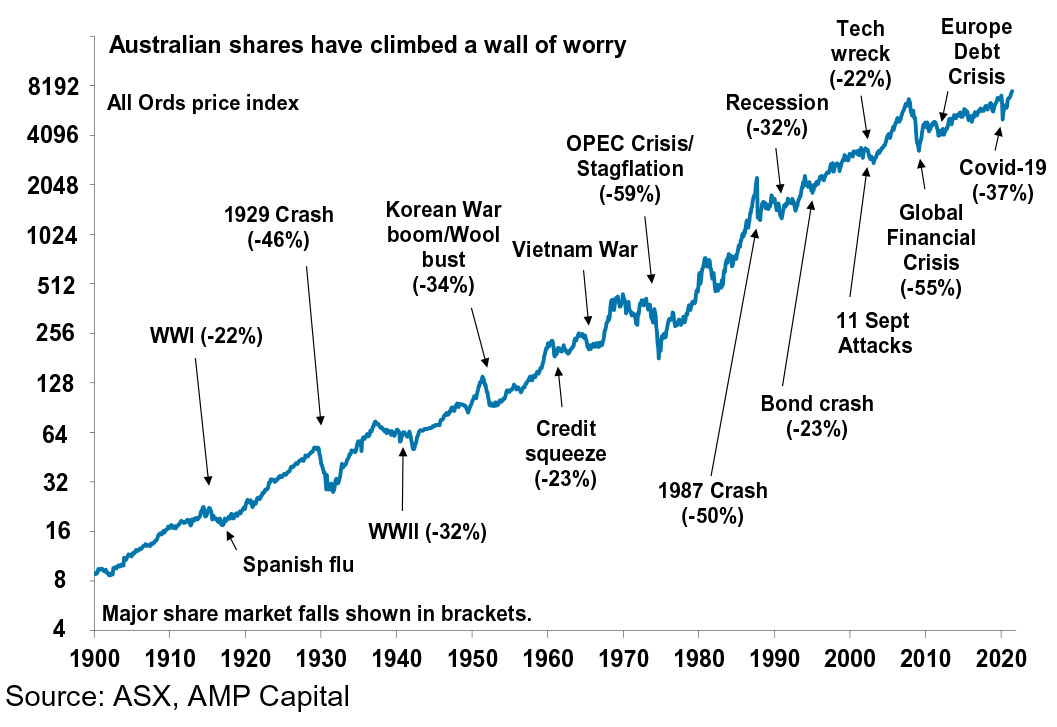

Since 1900 the world has experienced several flu pandemics, wars, credit crunches, debt crises, oil crises, stock market crashes and natural disasters. All these occurrences affected major share markets. Yet, Australian shares have climbed all the way through. Since 1900, Australian shares have returned 11.8% pa and US shares have returned 10% pa.

2. Understand how markets work

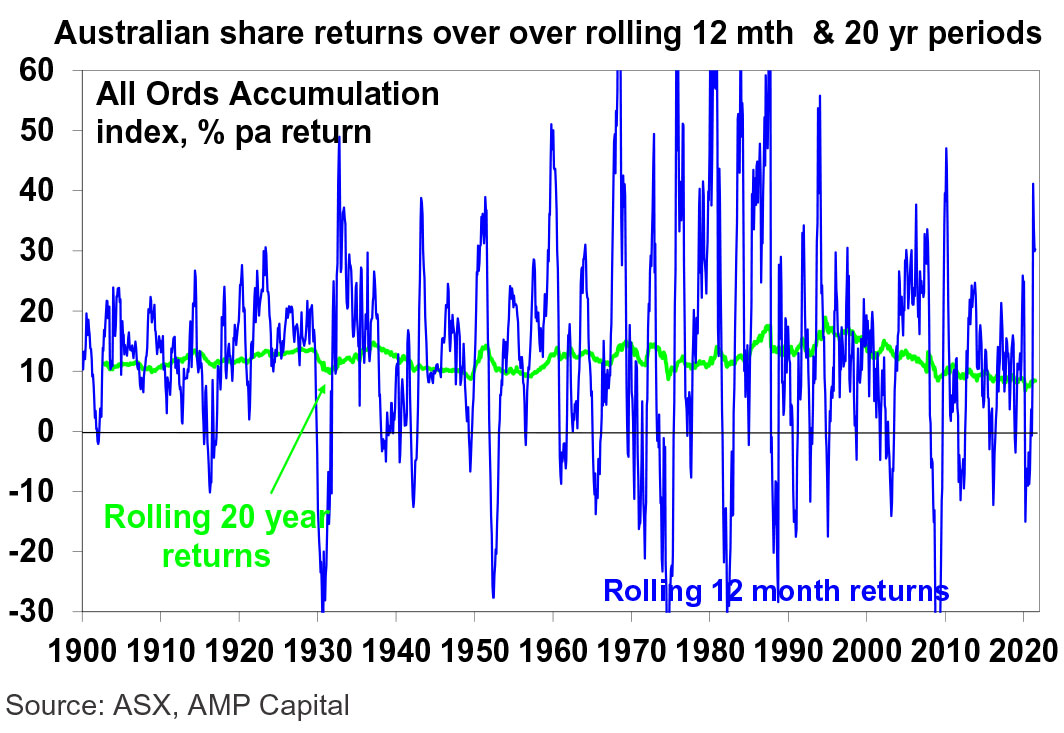

A diverse portfolio of shares returns more than bonds and cash in the long term because it can lose money in the short term. The chart below illustrates that while the share market can be highly volatile in the short term, it continues to produce strong returns over rolling 20-year periods.

3. Filter the news you consume regarding markets

There are two ways to do this. The first is to filter just how much news you consume. If you’re subscribed to many different news services while also following hundreds of people on Twitter and Facebook who are dialled into the markets, consider cutting back. The second is to filter where you get your news from. Be selective and if in doubt, check in with your financial advisor to see what services they use.

4. Don’t monitor your investments so frequently

If you’re checking your investments day by day, or worse, hour by hour, all you’re doing is causing yourself undue stress. And putting yourself in a position where you’ll be inclined to make emotional decisions over rational ones.

Historical data shows that if you check day to day, you’re going to get ‘bad news’ 50% of the time. If you check every month, this figure drops to less than 35%.

If you have it in you to check once a decade (ha!) your bad news percentage drops to 0%!

Short story, the less often you check on your investments, the fewer exposures you will have to numbers that might trigger the ‘loss aversion’ side of your brain.

And, of course, the beauty of having your financial advisor on call is that when the above fails, we’re always here to chat and help override the natural predilections of your brain!

—

Source: AMP Capital – Oliver’s Insights 14 July 2021

—

More like this

If you like this article, you might be interested to know that we share useful thoughts and information like this in our monthly financial insights email. You can subscribe to that email here. All subscribers receive a copy of our e-book: The 5 Key Pillars of Financial Independence.

If you like this article, you might be interested to know that we share useful thoughts and information like this in our monthly financial insights email. You can subscribe to that email here. All subscribers receive a copy of our e-book: The 5 Key Pillars of Financial Independence.

General Advice Disclaimer

This article contains general advice only, which has been prepared without taking into account the objectives, financial situation or needs of any person. You should, therefore, consider the appropriateness of the information in light of your own objectives, financial situation or needs and read all relevant Product Disclosure Statements before acting on the information. Whilst every care has been taken to ensure the accuracy of the material, Paradigm Strategic Planning or Sentry Advice Pty Ltd will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.

Paradigm Strategic Planning Pty Ltd is an Authorised Representative of Sentry Advice Pty Ltd AFSL 227748