What is income protection insurance? Put simply, it’s insurance that aims to protect your income in the event that you can’t work due to illness or injury.

How does income protection insurance work?

Income protection insurance provides an income stream for you should you become unable to work due to an injury or illness.

In the event of a claim, the insurer will pay an amount (normally up to 75% of your gross salary in Australia) until you have recovered sufficiently to work again, or up until the maximum benefit period as stated in the policy which is normally 2 years, 5 years or up to the age of 65.

Why do you need income protection insurance?

Ask yourself what would happen if you woke up tomorrow and found you were incapable of working for an extended period of time. Can you survive without your income for an extended period of time (12 months or longer)?

Income protection insurance provides cover for individuals, 24 hours a day, anywhere in the world, regardless of impairment.

If you don’t have savings it allows you to support your household, repay your mortgage and save for the future. You may think Workers Compensation will cover your costs in the case of an accident, but Workers Compensation only protects you if your injury is connected with work.

How much income protection cover do you need?

The amount of income protection cover you need will be determined by your salary. In Australia the maximum amount of cover you can get is usually limited to:

- If you are employed: 75% of your current gross salary (including employer packaged fringe benefits and superannuation contributions).

- If you are self-employed: 75% of the income generated by the business due to your personal endeavour less your share of expenses.

- A lower percentage of income may apply above certain income limits ($250,000 for example) and overall maximum levels of monthly benefit sum insured will apply.

What to consider when deciding your level of cover

You need to consider:

- The costs are of meeting your debts (mortgage, etc.)

- Providing sufficient funds for a spouse, children or other dependents

- Maintaining your assets and investments.

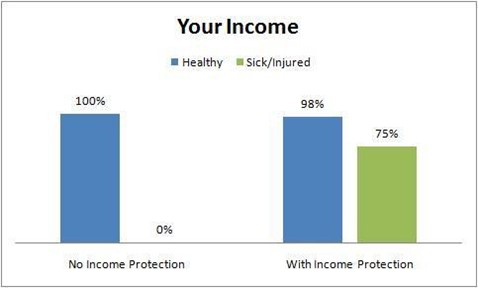

Remember, the point of income protection insurance is to provide an income stream if you can no longer work. Consider this:

What should you pay for income protection insurance?

Income protection premiums vary greatly across the market place depending on the level of protection you are after. Prices vary depending on age, the salary you want to insure and other factors, but as a general rule, income protection in Australia can cost around one week’s salary per year (approximately 2% of your annual salary). The most important thing to note is that for most taxpayers premiums are tax-deductible.

Income Protection Insurance Premiums are set depending on:

- Age – The cost of obtaining cover generally increases over time

- Gender

- Health and pre-existing conditions

- Whether or not you smoke – If you are a smoker, or if you have smoked within the last 12 months you will pay more in premiums compared to a non-smoker. However should you already have a policy and premium based on smokers’ rates and you have not smoked in the last 12 months you may be able to have your premiums reduced back to non-smokers

- Occupation – If you are involved in a hazardous occupation or where there are more risks involved, you will pay a higher premium compared to a professional office

- Waiting period – e. how long can you be off work before you require the income to commence. Generally the waiting periods range from 2 weeks to 2 years.

- Benefit Period – This is the maximum length of time following the waiting period that the policy will pay the benefit for. These can either be for a set period (2 year, 5 year) or until a certain age (to age 65). If you are able to return to work because you have recovered from your sickness or injury then the monthly benefit will cease at that time.

- Additional policy features – Whether you would like a ‘comprehensive’ or ‘basic’ policy or any additional features will also affect the cost of cover.

It’s always a great idea to speak with your financial advisors about whether you need income protection insurance, and if so, what levels of cover are right for you.

More like this

If you like this article, you might be interested to know that we share useful thoughts and information like this in our monthly financial insights email. You can subscribe to that email here. All subscribers receive a copy of our e-book: The 5 Key Pillars of Financial Independence.

If you like this article, you might be interested to know that we share useful thoughts and information like this in our monthly financial insights email. You can subscribe to that email here. All subscribers receive a copy of our e-book: The 5 Key Pillars of Financial Independence.

General Advice Disclaimer

This article contains general advice only, which has been prepared without taking into account the objectives, financial situation or needs of any person. You should, therefore, consider the appropriateness of the information in light of your own objectives, financial situation or needs and read all relevant Product Disclosure Statements before acting on the information. Whilst every care has been taken to ensure the accuracy of the material, Paradigm Strategic Planning or Sentry Advice Pty Ltd will not bear responsibility or liability for any action taken by any person, persons or organisation on the purported basis of information contained herein. Without limiting the generality of the foregoing, no person, persons or organisation should invest monies or take action on reliance of the material contained herein but instead should satisfy themselves independently of the appropriateness of such action.

Paradigm Strategic Planning Pty Ltd is an Authorised Representative of Sentry Advice Pty Ltd AFSL 227748